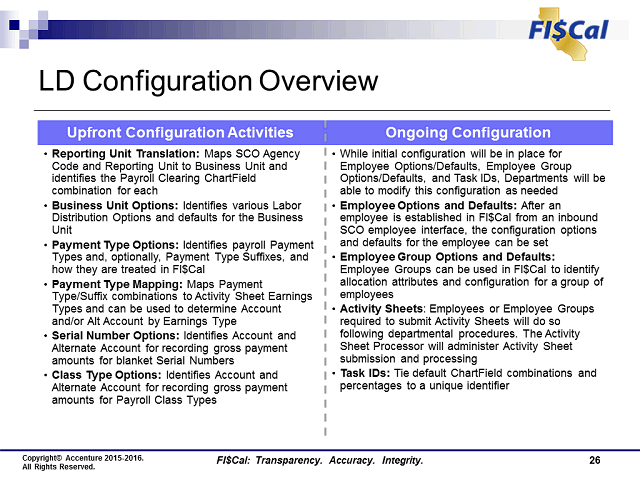

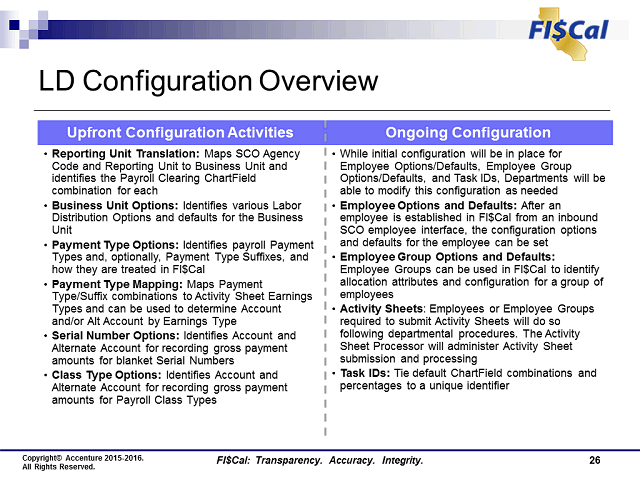

LD Configuration Overview

1. Upfront Configuration Activities

•Reporting Unit Translation: Maps SCO Agency Code and Reporting Unit to Business Unit and identifies the Payroll Clearing ChartField combination for each

•Business Unit Options: Identifies various Labor Distribution Options and defaults for the Business Unit

•Payment Type Options: Identifies payroll Payment Types and, optionally, Payment Type Suffixes, and how they are treated in FI$Cal

•Payment Type Mapping: Maps Payment Type/Suffix combinations to Activity Sheet Earnings Types and can be used to determine Account and/or Alt Account by Earnings Type

•Serial Number Options: Identifies Account and Alternate Account for recording gross payment amounts for blanket Serial Numbers

•Class Type Options: Identifies Account and Alternate Account for recording gross payment amounts for Payroll Class Types

2. Ongoing Configuration

•While initial configuration will be in place for Employee Options/Defaults, Employee Group Options/Defaults, and Task IDs, Departments will be able to modify this configuration as needed

•Employee Options and Defaults: After an employee is established in FI$Cal from an inbound SCO employee interface, the configuration options and defaults for the employee can be set

•Employee Group Options and Defaults: Employee Groups can be used in FI$Cal to identify allocation attributes and configuration for a group of employees

•Activity Sheets: Employees or Employee Groups required to submit Activity Sheets will do so following departmental procedures. The Activity Sheet Processor will administer Activity Sheet submission and processing

•Task IDs: Tie default ChartField combinations and percentages to a unique identifier

Press [Enter].